In this blog post I will detail how to fund your Tastytrade account from Europe/U.K., so that you may be able to buy US domiciled ETFs such as ARKK, TQQQ, and SOXL from Europe, where such ETFs are otherwise not accessible.

Earlier on we went through the process of opening a 🍒 Tastytrade account and creating a 💱 CurrencyFair account, both required before we proceed below.

Initiating the transfer

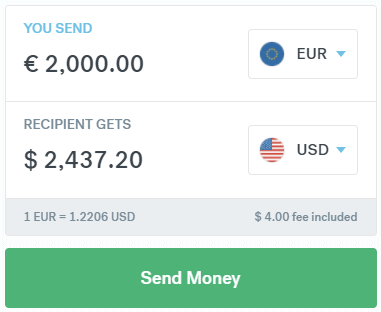

To fund Tastytrade from Europe/U.K., open the CurrencyFair website and check that the top right-hand corner says ‘My Account’. If not, login first. Now use the form to enter the amount you’d like to send.

If you signed up via my link, be aware that, in order to receive the 🎁 €70 free bonus, a minimum of €2,000 (or the equivalent in the depositing currency) needs to be transferred in a single transaction.

The recipient’s currency should always be set to USD. 💵

For this example, we will transfer €2,000. Click ‘Send Money’ to proceed to the next page where an overview of your transfer is once again shown. Click ‘Next’ to continue to the recipient details page.

⚠️ Pay close attention when filling out the following details!

| Requested information | Input |

|---|---|

| Name of account holder | Tastytrade via Apex Clearing |

| Country where account is held | USA |

| Account number | 1619329 |

| ABA number | 071000288 |

| Recipient’s Address | 350 N. St. Paul Street, Suite 1300 |

| Recipient City/Town | Dallas |

| Recipient State/County | Texas |

| Recipient Post/Zip Code | 75201 |

| Recipient’s Country of Residence | USA |

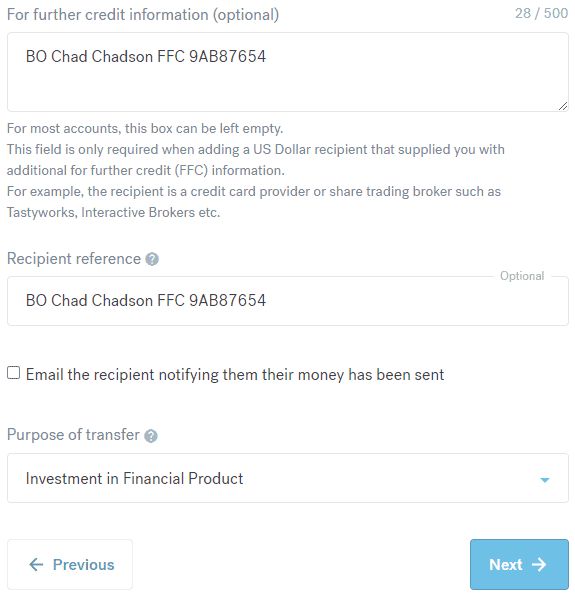

| For further credit information | BO [your full name] FFC [Tastytrade account number] |

| Recipient reference | BO [your full name] FFC [Tastytrade account number] |

| Purpose of transfer | Investment in Financial Product |

Note that the name of the account holder is ‘Tastytrade via Apex Clearing’, not your own name. The account number (1619329) and address are also different from your Tastytrade account. This is because we are transferring the money to 🍒 Tastytrade, who in turn will deposit it into your brokerage account. This is done by taking the information in the ‘for further credit information’ field. Be ware that this field only appears after filling out ⌨️ all previous fields!

BO stands for ‘by order of’, which is you, so provide your full name here. FFC stands for ‘for further credit to’, which should be your Tastytrade account, so be sure to correctly list your account number here.

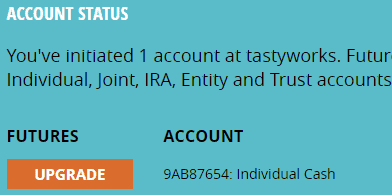

If you are unsure, you can find your account number by going to the Tastytrade homepage, clicking ‘Log in’, and checking the ‘Account status’ box. It should look something like this: 9AB87654.

Sending the money to CurrencyFair

Click ‘Next’, and now we can start sending the money from your 🏦 bank account to CurrencyFair, who will in turn send it to Tastytrade. Login to your personal bank account and initiate a money transfer for the amount you have chosen earlier.

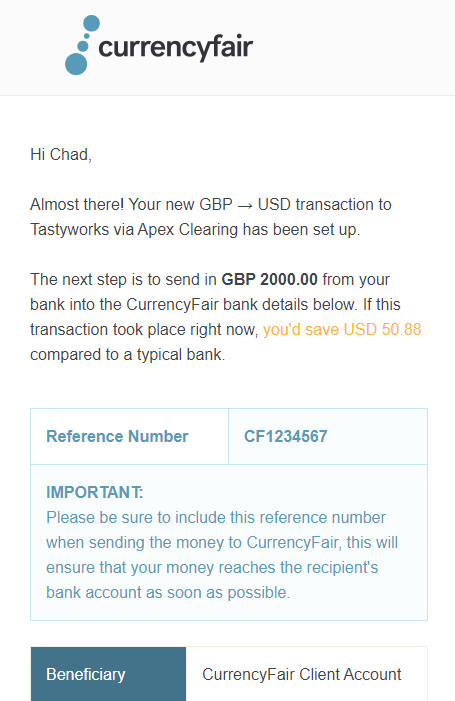

Consult the CurrencyFair page for the details of the recipient. You should also receive an 📧 email containing the same.

I have provided a screenshot as an example, but be careful as the details are entirely dependent on the currency and amount you’re depositing!

In your own bank’s interface, some information may not be required for the transfer, though you will need to put in at least the name (or ‘beneficiary’), IBAN, and payment reference, which should look something like CF1234567 and is different for every account. Without a payment reference, CurrencyFair will not know what transaction your money belongs to and thus fail!

Depending on the currency, it should generally take between 1 and 3 business days 🕒 for your money to arrive at CurrencyFair. You will receive a confirmation email once the funds have been received. From this moment on, it can take a few more days for it to clear and appear in your Tastytrade account, because it is sent through an intermediary bank first.

You can find an overview of the processing times per currency here.

While waiting, why not leave a comment below and share your experience?

Informing Tastytrade

In the meanwhile, it is advisable to send Tastytrade a notification via email to prevent any issues (they recommend this themselves when using CurrencyFair). Once you have received the email confirming your transfer is on its way, you can then forward this email to banking@tastytrade.com, along with your Tastytrade account information.

From initiating the transfer, it can take around a week to fund Tastytrade from Europe.

Once your funds have been received, the status of your Tastytrade account will change to ‘Funded’. You will now be able to start buying 📈 US ETFs. More on this in the next blog post.

Overview of fees to fund Tastytrade from Europe

Though CurrencyFair is among the, if not the, cheapest money transferring services available—charging just $4 + conversion per transfer—transfers to Tastytrade have to go through an intermediary bank that does charge a $20 fee. Unfortunately there is no way around this, though if you signed up using my link you will receive a €70 bonus 💶 that should cover some of the fees.

⚠️ Note that the $20 fee to fund Tastytrade from Europe is not specified during the transfer via CurrencyFair, because it is not CurrencyFair (or Tastytrade) charging the fee, but an intermediary bank.

Aside from the fixed fees, there are some conversion fees as well. On average those will amount to 0.4% of the total amount, depending on the currency. Please find a brief estimate of fees below for some common amounts. It is advisable to transfer big amounts 💰 at once instead of in multiple smaller transactions.

| Amount sent | Fees | To receive |

|---|---|---|

| $2,500 | 20 + 4 + 10 = $34 (1.36%) | $2,466 |

| $5,000 | 20 + 4 + 20 = $44 (0.88%) | $4,956 |

| $7,500 | 20 + 4 + 30 = $54 (0.72%) | $7,446 |

| $10,000 | 20 + 4 + 40 = $64 (0.64%) | $9,936 |

| $25,000 | 20 + 4 + 100 = $124 (0.50%) | $24,876 |

| $50,000 | 20 + 4 + 200 = $224 (0.45%) | $49,776 |

| $100,000 | 20 + 4 + 400 = $424 (0.42%) | $99,576 |

Tastytrade does not charge any fees for buying and selling stocks and ETFs, while most European 🌍 brokers do. Along with the €70 bonus, this should at least partially make up for the transfer fees. Aside from that, European brokers also charge conversion 💱 fees when trading in USD, so this fee is paid either way.

Looking to diversify your portfolio?

Why not add a little crypto? Sign up with Coinbase—one of the world’s largest and most reliable exchanges—and receive $10 worth of Bitcoin for free, when buying at least $100 worth of crypto.

Claim free gift! 🎁

Hi,

Excellent blogs, I now have a funded tastyworks account!

Did you figure out where the $20 fee goes to? If currencyfair transfers from an us bank to tastyworks, one would think the fee would be lower than $20… It’s not a big amount if you transfer thousands of euros, but prevents e.g. small monthly transfers.

Have you tried withdrawing money from tastyworks via currencyfair? I wonder if that will work, or does tastyworks require a destination bank account with your name.

Hi Tomba, glad you find the blog helpful. 🙂 The $20 fee goes to an intermediary party. Neither CurrencyFair nor Tastyworks receives it, but a bank in between. Because this bank works with wires only (not free ACH) it’s quite steep… Unfortunately there’s no way around this fee, and luckily you get free trading with Tastyworks to make up for it, I suppose.

You can withdraw via wire back to CurrencyFair for $25 (put your CF account number in the FFC field), or directly to an IBAN, but that costs $45. Regardless, I personally would only withdraw maybe once a year at most.

Hope this helps!

Hi, thanks for the info.

Regarding the withdrawal: so it costs 25 $ to withdraw money to Currencyfair, and then how much does it cost to send it from Currencyfair back to Europe?

Hi Phil, glad to be of help. To transfer from CurrencyFair to your European bank account costs just €3. Of course you also pay to convert from USD back to EUR/GBP/… but this would happen regardless and you’re probably getting a better rate with them than your own bank.

Hi,

Would the withdrawal fee be the same as the deposit fee, or higher (lower)?

Thanks!

Hi Aleks, withdrawal to CurrencyFair costs $25 (put your CF account number in the FFC field), to an IBAN costs $45. Personally, I don’t really make withdrawals, but it is good to keep costs in mind.

Hope this helps!

Hi, Thank you for the amazing Blogs! I signed up to Currency Fair.

Many thanks

hi,

you mentioned a 0.4% conversion fee of thie article, but it is not included in the first picture of this article.Where can I find the information about this conversion fee? Thank you.

i have figured it out :). it is already included in exchange rate…

Hi thanks for this.

When withdrawing to CurrencyFair, are there any other fees that get added? Is there an intermediary bank charging a fee like there is when you deposit funds? Or is it just a fixed $25 (plus conversion and transfer out from CF)? Thanks for your help

Hi Rem, should be just the $25. You can then withdraw from CurrencyFair to your bank for €3 plus conversion to EUR/GBP/CHF/etc. You can also withdraw directly from Tastyworks to a European IBAN, but it costs $45 and your own bank will do the conversion, so it’s a lot more expensive. Hope this helps! 🙂

Hi! Very great writing!!! 🙂

If I have 1500$ in my bank and I want to deposit it to Tastyworks via CF, how much will it be? Will it be handled as domestic wire transfer? So 20$+25$ is the total fee, so 1955$ will be recieved to invest?

Glad you found the article helpful. 🙂 To answer your question, if you got $1500 in your account and it’s already in USD, you’ll not pay any conversion costs.

If the account is already in the US (and a real bank account, not a transfer service), I would just use ACH to transfer for free and you can invest the full $1500.

If the account is outside of the US, transfer the $1500 to CurrencyFair and from there wire to Tastyworks. You’ll pay $4 to CurrencyFair and $20 to the intermediary bank, so you’ll end up with $1476 on Tastyworks.

If it wasn’t already in USD, you’ll also pay ~0.4% conversion fees.

Thank you, you are the Best!!! 😀

But is Wire 25-45$ anyway?

ACH is the only free option

Hi, your blogs are super valuable! I was wondering if it might be possible to open an US bank account and transfer from currencyfair to US bank account first, then ACH transfer to tastyworks. I’ve seen some discussion that it’s possible for EU citizens/residents to open a US bank account. Have you looked at this route?

Thanks!

Hi, if you have a U.S. bank account, you can indeed ACH transfer to Tastyworks directly (for free). I have a U.S. bank account myself and it works. However, it is generally not possible to open such accounts outside of the U.S., especially if you’re not an American citizen either. The method I describe will work for anyone. 🙂

How did you manage to open a US account? Can I transfer the funds to Interactive Brokers convert EUR to USD there, then withdraw. And send the already converted USD to TastyWorks via Currencyfair. Like that a don’t need to pay 0.04% just 2$ fixed dollar at IBKR. But I’m not sure If I can withdraw dollars to my European bank account without fees

Hi Ignacio, though I’ve heard of this method, I’m not an Interactive Brokers client myself and thus I cannot advise on this, unfortunately. Hope it works well for you!

For those who have an InteractiveBrokers (IB) EU account. Or an account from an InteractiveBrokers reseller:

You can also wire from an IB account directly to Tastyworks (TW). You have 1 free outgoing wire per calendar month. Dollars come from IB’s US JPMorgan bank account and are transferred under your name. It’s domestic and not considered 3rd party, so no extra costs. IB’s spread on currency conversion is amazing: I had 0.00001 last time. It only costs you $2 per time, unless you’re converting large amounts. Check with IB for detailed info.

Outbound: didn’t test yet but you also should be able to wire back from TW to IB’s US account. TW charges $25 for an outbound domestic wire. But again you can use the low cost IB currency conversion here to get back to your home currency.

Might even be worth to take an IB account just for this. But be sure to check their inactivity fees.

Hi Gerben, I did consider this method after someone suggested it to me, but considering the inactivity fee of $20 this is not a preferable solution to me. If you’re already an active client it might be a good option though. 🙂

I understand. Couple of remarks on that:

1. You can get the inactivity fee down to $10 per month if you have $2000 in assets there. With $100000 in assets it’s $0.

2. There are some EU Interactive Brokers (IB) resellers with lower or no inactivity fee.

3. If you plan to transfer money monthly to Tastyworks, then even with the inactivity fee IB is cheaper then Currencyfair due to the lower currency conversion costs and no intermediary banking fee.

Also tested the way back from Tastyworks to IB btw. Works fine and is also considered domestic. So you only get charged $25 by Tastyworks.

Only disadvantage of the IB Tastyworks construct might be speed. IB locks your money 3 business days before you can transfer further along. If you do transfer after that it’s generally available the next day in your Tastyworks account though.

How do you transfer your funds directly to Tastyworks from Interactive Brokers?

Hey Gerben. To send $ from IB to Tastyworks, what did you fill in at the Financial Institution’s Bank Account Number and then the receiving bank fields? I’d like to try this method and not sure at all. Thanks for the help

Hi,

I recently opened a cash account and I am planning to open a margin account in a few months when I get more comfortable with the platform. Is it possible to transition money between these two accounts without any fees? I dont mind terminating my cash account once I decide to open a margin one.

Hi, in this case I would simply activate margin for your current account, no need to open a new one. As for transfers, the accounts themselves aren’t bank account, so you cannot transfer directly between them, unfortunately.

Hi, I recently opened account using your provided link, but I am not sure if I did it properly. Is there a way to check on the currencyFair if I get my bonus after I transfer the money?

Hi Stanislav, not that I know of. You should get it fairly quickly after the transfer has been fully processed. If there is an issue, you can always contact support though!